Smarter Upskilling for Finance Pros Through Personalized Learning

Summarize with:

Due to various factors, life will be full of uncertainties in 2024. On average, people can expect to live around 73.33 years. Despite the fast pace of time, businesses emphasize the importance of insurance in safeguarding individuals and families, ensuring they can access medical support and live happily regardless of challenges.

As technology advances, customers’ expectations also change, shaping how finance services are delivered.

Finance professionals should prioritize training modules within the industry to improve their skills. They should also embrace technologies like AI and data analytics to boost sales and meet customer expectations.

This article will cover the key benefits of finance training programs and practical training approaches.

Table of Contents:

- What is Personalized Learning?

- The Need for Personalized Learning for Finance Professionals

- Challenges Faced in Personalized Learning in the Finance Sector

- Best Practices for Personalized Learning in the Finance Sector

- How to Implement Personalized Learning in the Finance Sector?

- 5 Benefits of Personalized Learning for Finance Professionals

- The Path to the Future

What is Personalized Learning?

Personalized learning is a method used in workforce learning and development where the course content is tailored to address each learner’s skill gaps, strengths, weaknesses, interests, and goals. It is a data-driven approach where the data is collected through employee assessments and interviews.

The learner can choose their learning paths, and it is often self-paced and self-regulated. It includes adaptive learning, which allows for training to be interactive and technology-powered.

The Need for Personalized Learning for Finance Professionals

Here are a few reasons why personalized learning for professionals in the finance sector is a must:

- The need to adapt to constantly evolving technology through consistent skill development

- Hyper-specific expertise is required for diverse finance roles

- The necessity to understand and apply complex financial concepts quickly

- Efficient time utilization and creating a balance between upskilling and project execution

- The demand from clients who want to migrate to newer technologies for their personal needs

- The requirement to meet varied regulatory frameworks, etc.

Challenges Faced in Personalized Learning in the Finance Sector

Personalized learning in the finance sector is not without its challenges. Some of the common challenges are:

1. Content Quality and Relevance

Personalized learning requires creating and updating a large amount of content that matches the learners’ needs and interests. This poses the challenge of ensuring the quality and relevance of the content and avoiding duplication and inconsistency.

Organizations need to adopt a systematic and rigorous process for content creation, curation, validation, and maintenance.

2. Learner Engagement and Retention

Personalized learning relies on the learners’ active participation and self-regulation. This poses the challenges of ensuring learner engagement and retention and avoiding learner isolation and frustration.

Organizations need to provide a supportive and collaborative learning environment that fosters learner motivation, feedback, recognition, and social interaction.

Best Practices for Personalized Learning in the Finance Sector

To overcome these challenges of workforce learning and development, organizations need to follow some best practices for personalized learning in the finance sector, such as:

- Define clear and measurable learning objectives and outcomes

- Use data and analytics to inform the design, delivery, and evaluation of personalized learning

- Leverage technology and platforms that enable personalized learning

- Provide personalized support and guidance to the learners

- Encourage learner autonomy and choice

- Foster learner collaboration and community

- Incorporate gamification and storytelling elements to enhance learner engagement

- Review and improve personalized learning continuously

How to Implement Personalized Learning in the Finance Sector?

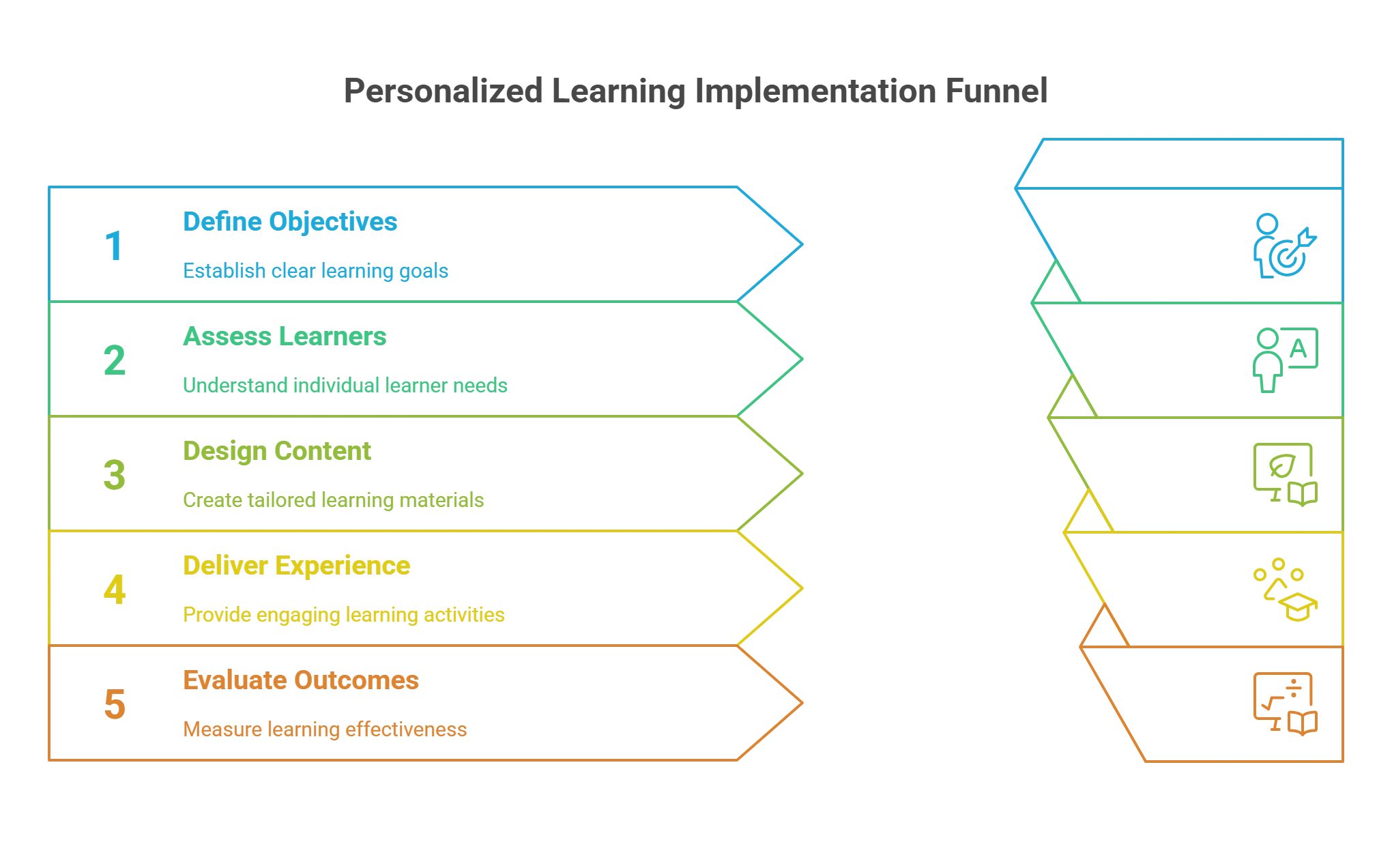

To implement personalized learning in the financial industry training effectively, organizations need to follow a systematic process that involves the following steps:

1. Define the Learning Objectives and Outcomes

The first step is to identify the specific skills and competencies that finance professionals need to develop or improve.

This can be done by conducting a skills gap analysis or a competency framework assessment. The learning objectives should be aligned with the organizational goals and strategies.

2. Assess the Learners’ Profiles

The next step is to collect data on the learners’ profiles. This includes their current level of knowledge and skills, their learning needs and goals, their preferences and learning styles, and their motivations and challenges.

This can be done by using surveys, interviews, assessments, or observations. These methods can help gather quantitative and qualitative data on the learners’ characteristics, behaviors, and outcomes.

The data can then be used to create learner personas, profiles, or segments that can guide the personalization of the learning content and activities.

3. Design the Learning Content and Activities

The third step is to create learning content and activities that match the learners’ profiles and objectives. The content should be relevant, accurate, updated, and engaging, and the activities should be interactive, immersive, and adaptive.

The content and activities should be delivered in various formats and modes, such as text, audio, video, animation, simulation, game, quiz, etc. They should also be modularized and personalized to allow the learners to choose their learning path and pace.

4. Deliver the Learning Experience

The fourth step is to deliver the learning experience to the learners using the appropriate technology and platform. The technology should enable the learners to access the content and activities anytime, anywhere, and on any device.

The platform should provide a user-friendly and intuitive interface that facilitates the learners’ navigation and interaction. It should also support the integration of various tools and features, such as data collection, analytics, feedback, coaching, recognition, etc.

5. Evaluate the Learning Outcomes

The final step is to evaluate the learners’ learning outcomes using data and analytics. The data should capture the learners’ progress, performance, engagement, satisfaction, and impact.

The analytics should provide insights into the learners’ strengths and weaknesses, the effectiveness and efficiency of the content and activities, and the areas for improvement and innovation.

The evaluation should also involve feedback from the learners, instructors, managers, and stakeholders.

5 Benefits of Personalized Learning for Finance Professionals

Since the term personalized learning was used in a book in the 1960s, its meaning has evolved. What has remained constant is the myriad of benefits it offers for workforce transformation. Let’s look at what it can do for professionals from the finance industry:

1. Honing Specific Skills with a Tailored Approach

Customized learning offers finance professionals a chance to improve specifically where they need to, using state-of-the-art learning technology in finance. A study found that a personalized learning system supports a learner’s needs and interests, facilitating the learning process.

Nothing short of a personalized training program could meet the job requisites, bringing in precision and efficiency through micro-knowledge acquisition. From risk analysis to cybersecurity, the sky is the limit for the number of fields in the finance industry.

For example, without personalized learning, an analyst who wants to learn financial modeling specifically might find themselves studying business analysis as a whole. This leads to wasted time and effort, delayed skill-building, and, ultimately, employee dissatisfaction.

2. Flexibility with a Self-Paced Learning Path Amidst Demanding Schedules

In a quick-moving industry, personalized learning allows finance professionals to learn at their own time and pace. Learning on the go is an unparalleled advantage offered by self-paced banking training or training of any other kind. Remote or mobile learning ensures employees stay caught up when work is hectic, making bridging skill gaps easier.

Research on the impact of self-paced learning courses found that they allow learners to feel more confident about the material. This is an added advantage.

3. Higher Retention of Complex Financial Topics

The finance industry is vast and dynamic. When financial services upskilling is done by considering an individual’s needs, goals, and learning styles, they are more likely to retain that information due to increased engagement. For the finance sector, this is a big win, as attention to detail is vital, and the learning material is often complex.

A personalized learning pathway can improve retention by 64 to 75%. When you remember what you learn, its applications are also seamless, enhancing overall performance in the job at hand.

4. Quicker Career Progress in a Diverse Industry

With the above advantages combined, a finance professional gets a tailored education and consistent access to effective upskilling. This leads to better time utilization, targeted skill building, increased qualifications, and higher adaptability for innovation. It is essential for an industry with highly diverse roles that are constantly changing.

It is supported by a study that found that training increases job performance and productivity. When an individual is well-trained, it increases the probability of their advancing in their careers.

5. Meeting Regulatory Compliance and Avoiding Potential Legal Pitfalls

A quick search on Wikipedia would tell you that there are at least a hundred different financial regulatory authorities worldwide. Taking a micro-learning approach through personalized learning would allow professionals to understand the compliance requirements specific to a project they are a part of in the present or will be in the future.

Navigating through regulatory frameworks and meeting the legal requirements can avoid legal pitfalls that often land jobs in jeopardy.

The Path to the Future

Plato’s famous quote, “Necessity is the mother of invention,” applies aptly to personalized learning in the BFSI industry. While it got a push from the COVID-19 pandemic, personalized learning is here to stay, with new technologies like AR, VR, AI, blockchain, cloud banks, etc., emerging constantly.

Engaging employees through personalized learning solutions offers multiple advantages for organizations to stay ahead of the curve. The benefits are even immense for individuals who want to remain relevant, progress, and effect change in the years to come.

If you want to build personalized learning solutions for your organization in the BFSI industry, Hurix Digital has everything you need under one roof. Hurix Digital has expertise in creating fully customizable learning solutions that deliver immersive learning experiences designed to improve skills and productivity. From mobile learning to gamified courses, with Hurix Digital, there is a lot to gain from.

Book a free consultation or get in touch to get started.

Summarize with:

Senior Vice President

Julia brings over 20 years of global experience in digital learning and business strategy. She specializes in client success, enterprise learning solutions, and driving growth through innovation, with a focus on AI, VR, and emerging technologies across diverse industry verticals.

A Space for Thoughtful

A Space for Thoughtful